Social’s popular on the web still too (not just apps)

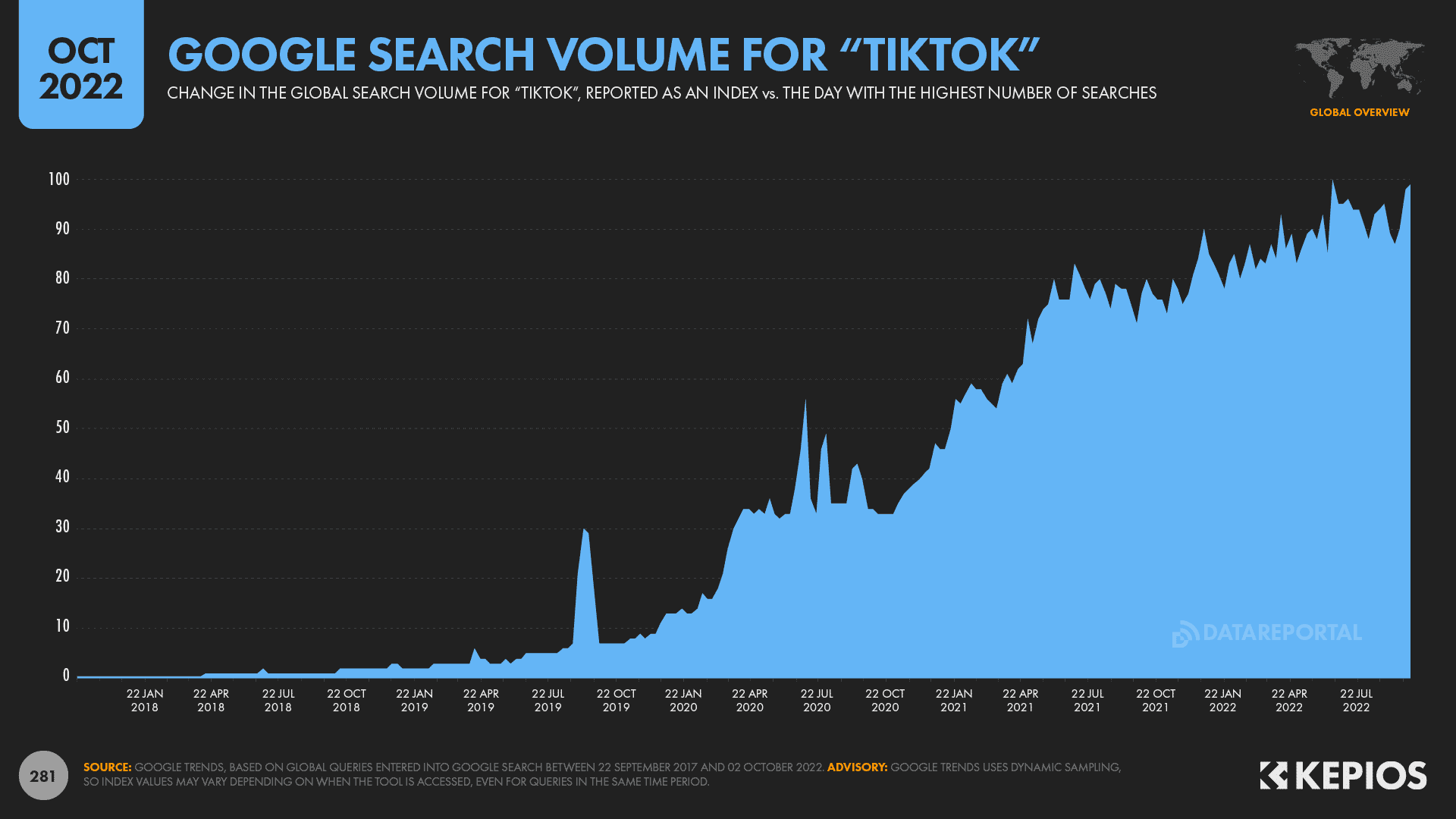

While it’s no secret that TikTok has been adding millions of users over recent months, the platform has seen impressive growth in another metric that may come as more of a surprise.

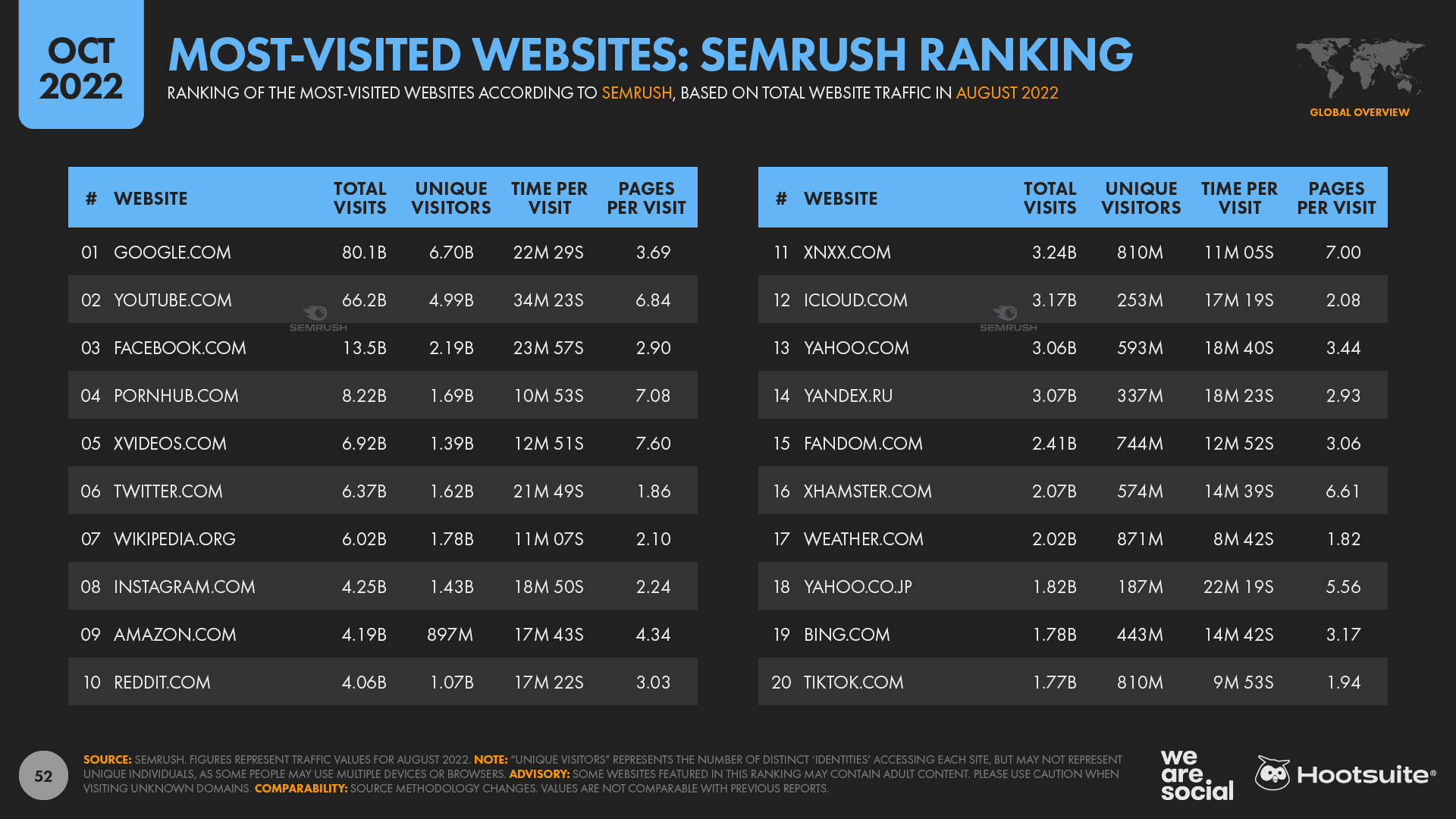

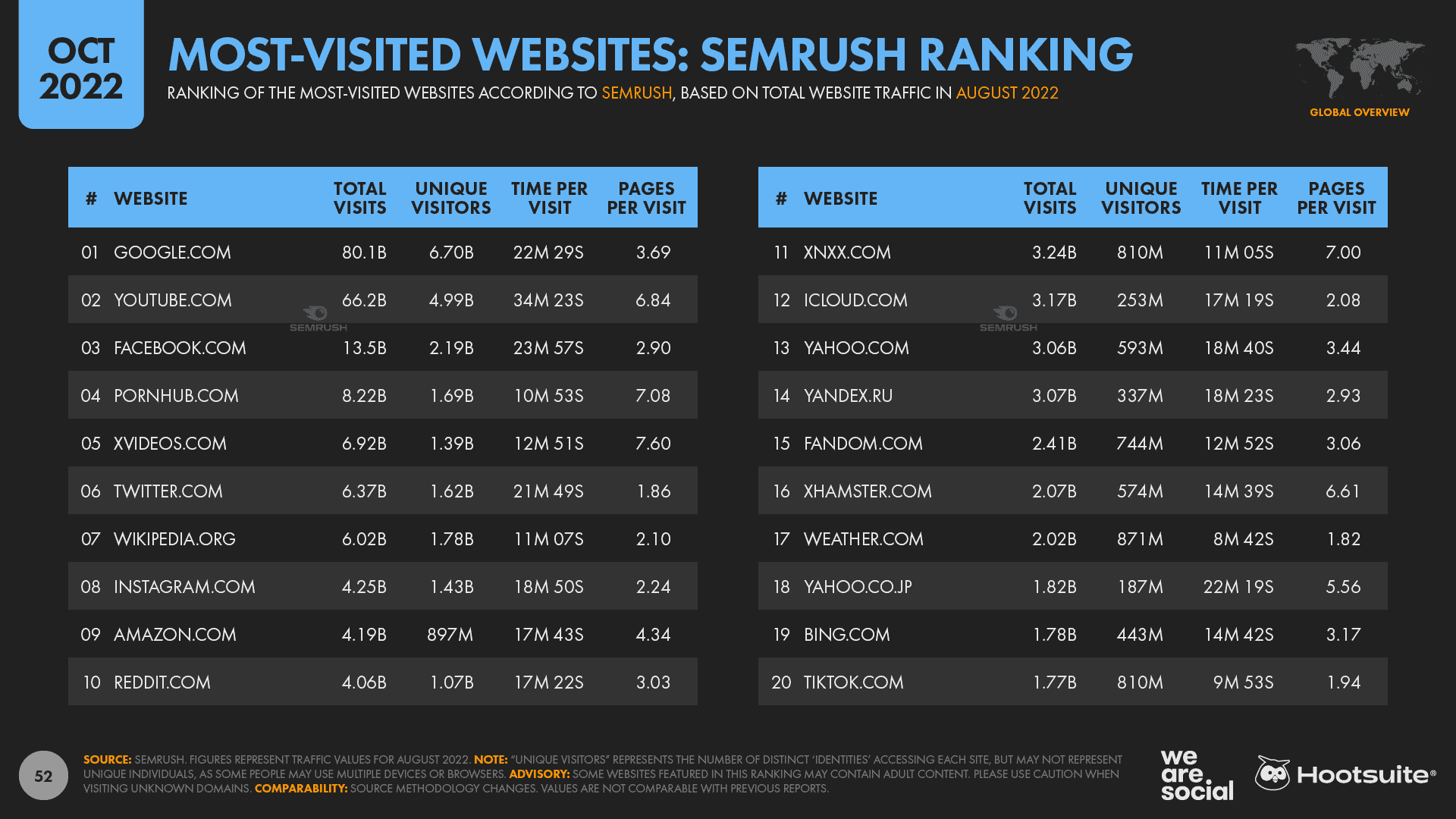

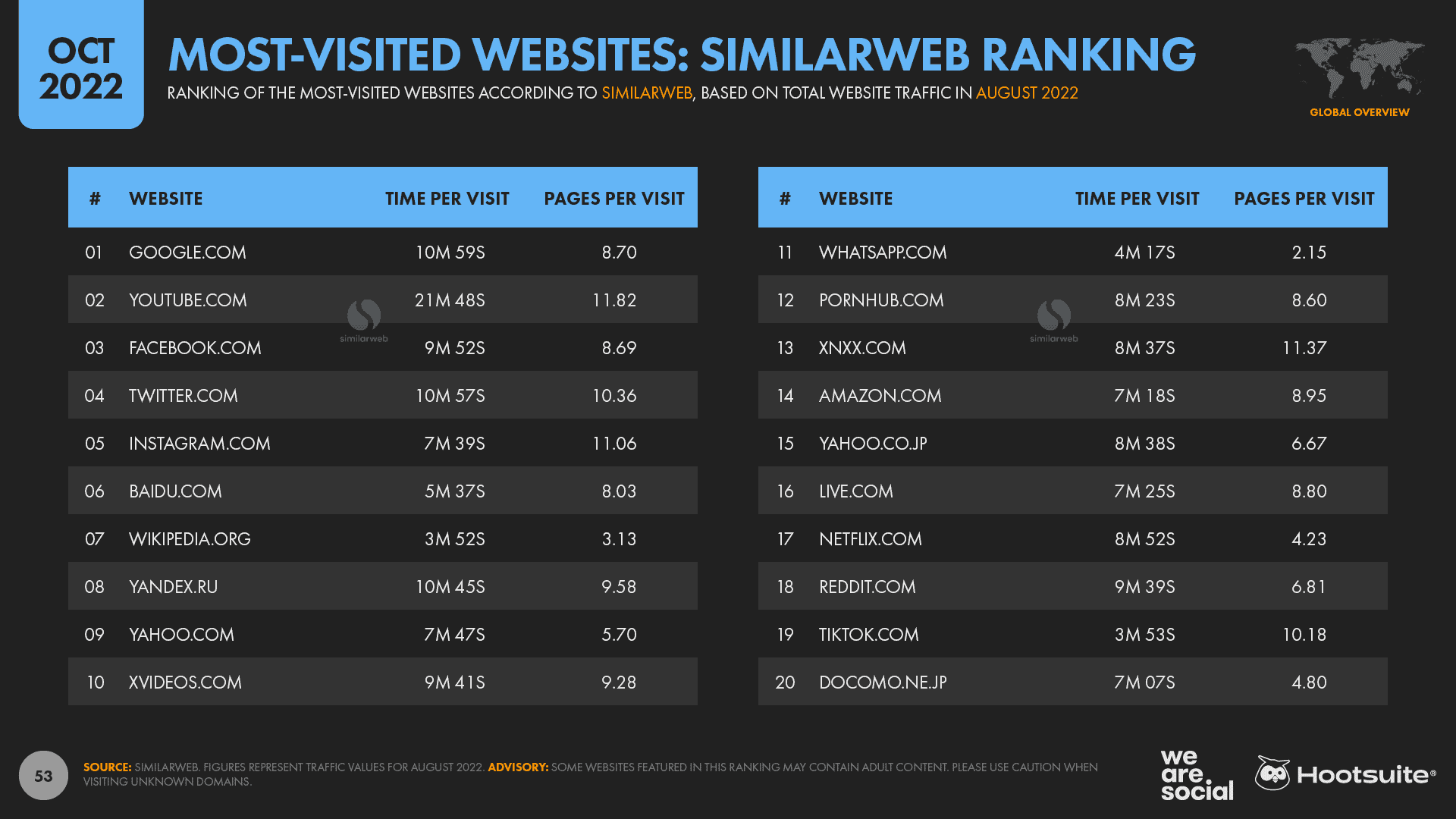

Both Semrush and Similarweb report that TikTok.com has now entered the top 20 most-visited websites in the world.

In other words, TikTok isn’t just one of the world’s biggest mobile apps; it’s also one of the hottest properties on the web.

To put this in perspective, Semrush reports that TikTok.com now attracts more than 800 million unique visitors per month, which may equate to more than half of the platform’s total active user base.

Meanwhile, data from Google Trends also reveals that searches for “TikTok” have increased steadily over recent months.

Across all queries entered into Google around the world between 01 July and 20 September 2022, TikTok ranked 25th by total search volume.

And given similar trends for Facebook, Instagram, and WhatsApp Web, there’s a good chance that many of these searches were conducted by people hoping to consume TikTok content from within a web browser, as opposed to people simply looking to learn what TikTok is, or to download the app.

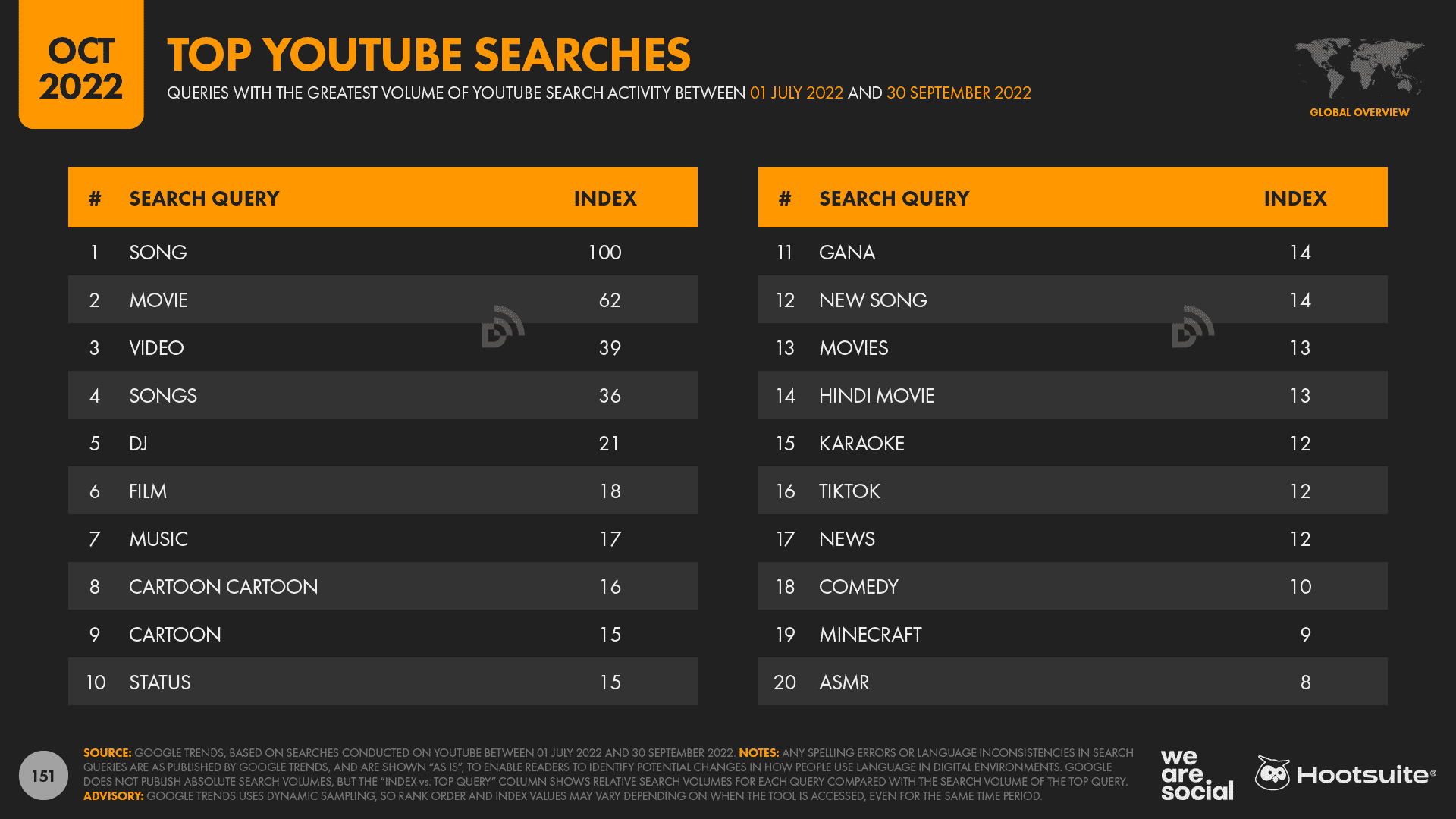

As an aside, it’s also interesting to note that “TikTok” currently ranks 16th in the world’s top queries on YouTube.

There’s a certain irony to these search trends though, considering that Google execs are increasingly worried about the number of people who’ve moved their search activity from search engines to social platforms.

There’s little data to tell us whether TikTok’s web users are any different to the users of its mobile app, but—even if users were to be the same – the usage context in a web browser will likely be quite different to the one in the platform’s app.

Having said that, the TikTok experience is no less compelling in a web browser, with visitors landing directly in a “for you” feed without needing to create an account or log in (try it for yourself here).

It’s unclear whether this rise of TikTok activity in web browsers has any distinct implications for marketers, but nonetheless, it’s worth considering if you’re planning TikTok content.

But it’s important to note that this “social web” phenomenon isn’t unique to TikTok.

Semrush’s latest data reveals that the websites of most of the top social platforms continue to attract billions of unique visitors each month, although it’s worth noting that – due to people’s use of multiple connected devices—these figures may include a meaningful degree of duplication when it comes to unique individuals.

YouTube sees the highest number of unique visitors to its website, with Semrush reporting that a whopping 5 billion unique devices visited YouTube.com in August 2022.

Meanwhile, despite the company’s own data suggesting that app usage dominates Facebook access, more than 2 billion unique devices also visited Facebook.com in August.

The websites of Twitter and Instagram continue to attract well over a billion unique visitors each month too.

And the number for Twitter is particularly interesting, because it suggests that a significant number of people continue to use the platform without logging in – and perhaps without even creating an account.

Similarly, despite the platform reporting unique daily users of just 50 million, Reddit’s website also attracts more than 1 billion unique visitors each month, suggesting that many of the platform’s visitors don’t register or log in.

And while it sits just outside of Semrush’s current top 20, Similarweb reports that WhatsApp.com is also a favorite on the web, attracting more unique visitors than many of the world’s top adult sites.

Top 10 takeaways

If you’re short on time, the YouTube video below will guide you through 10 of the top stories in this quarter’s data.

However, read on below that for our complete October report, and for my comprehensive analysis of this quarter’s key insights and trends.

And with this being our last report of 2022, I’ll finish up this quarter’s analysis with my take on the key themes and trends that I believe will shape and define digital success in 2023.

Just before we dive into all of those stories though, please read the following notes carefully, to ensure that you understand how recent changes in underlying data and research methodologies may impact this quarter’s findings.

Reels keep rolling

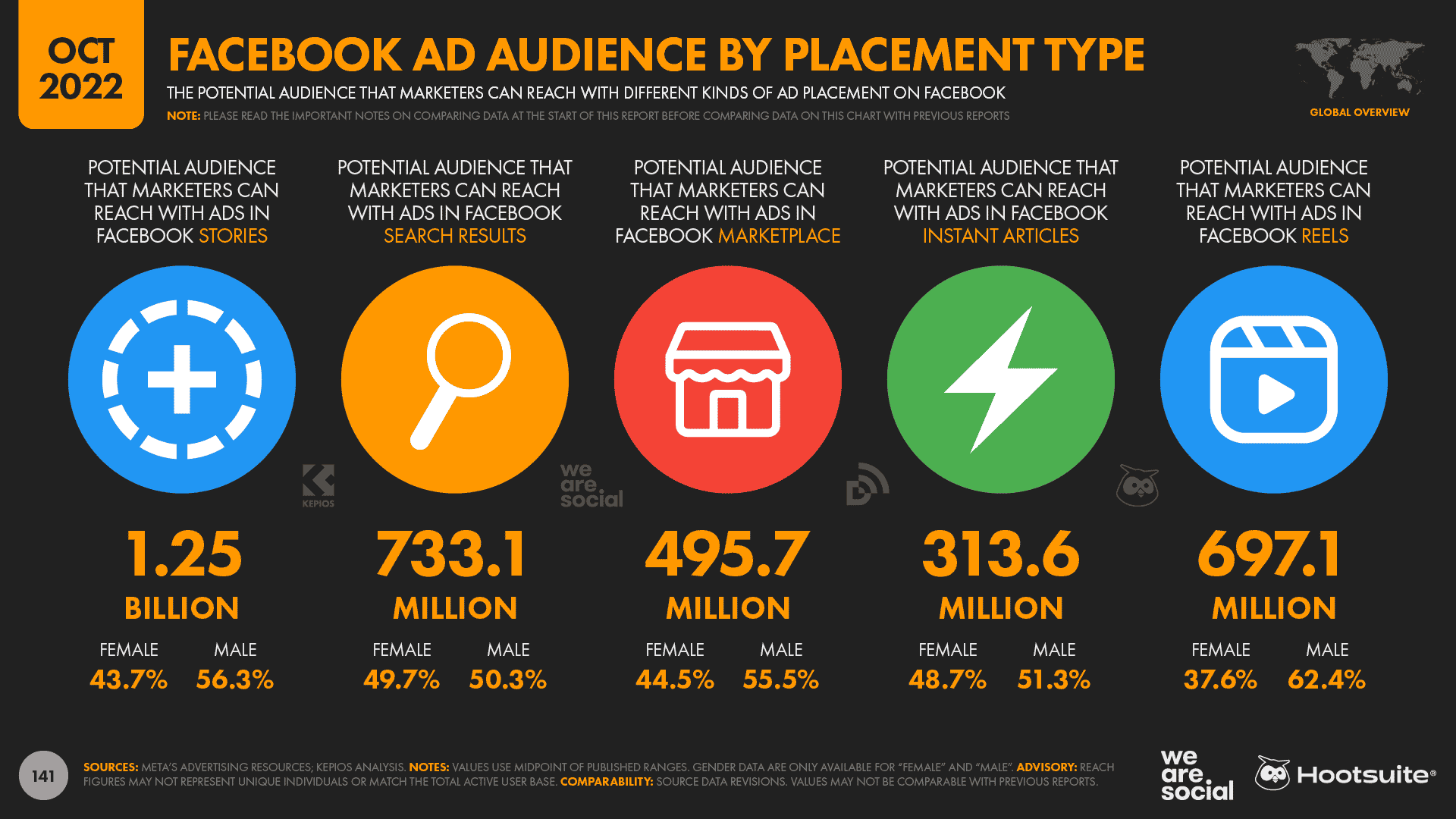

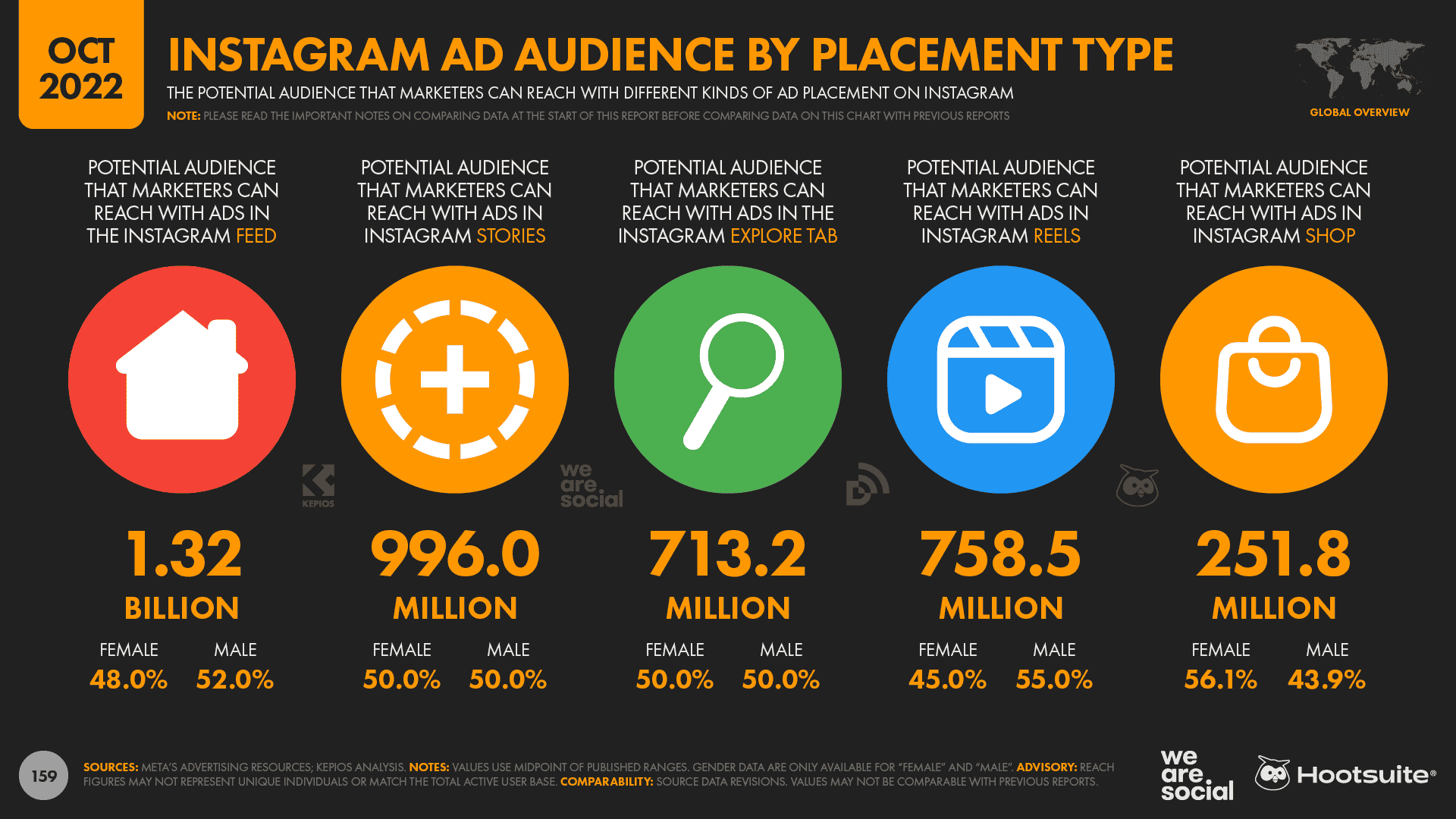

The number of users that marketers can reach with ads in Meta’s Reels feeds continues to grow.

Figures published in the company’s ad planning tools reveal that the global audience for ads in Facebook Reels has jumped by almost 50% over the past three months.

The latest potential reach figure is just a shade below 700 million users, reflecting an increase of more than 220 million users since July 2022.

The number of users seeing ads in Instagram’s Reels feed has also increased since last quarter, albeit at a much more modest rate.

Figures for October 2022 show that Instagram Reels ads now reach 758.5 million users, which is 0.5% more than the 754.8 million users that Meta’s ad planning tools reported back in July.

TikTok’s revenues continue to grow

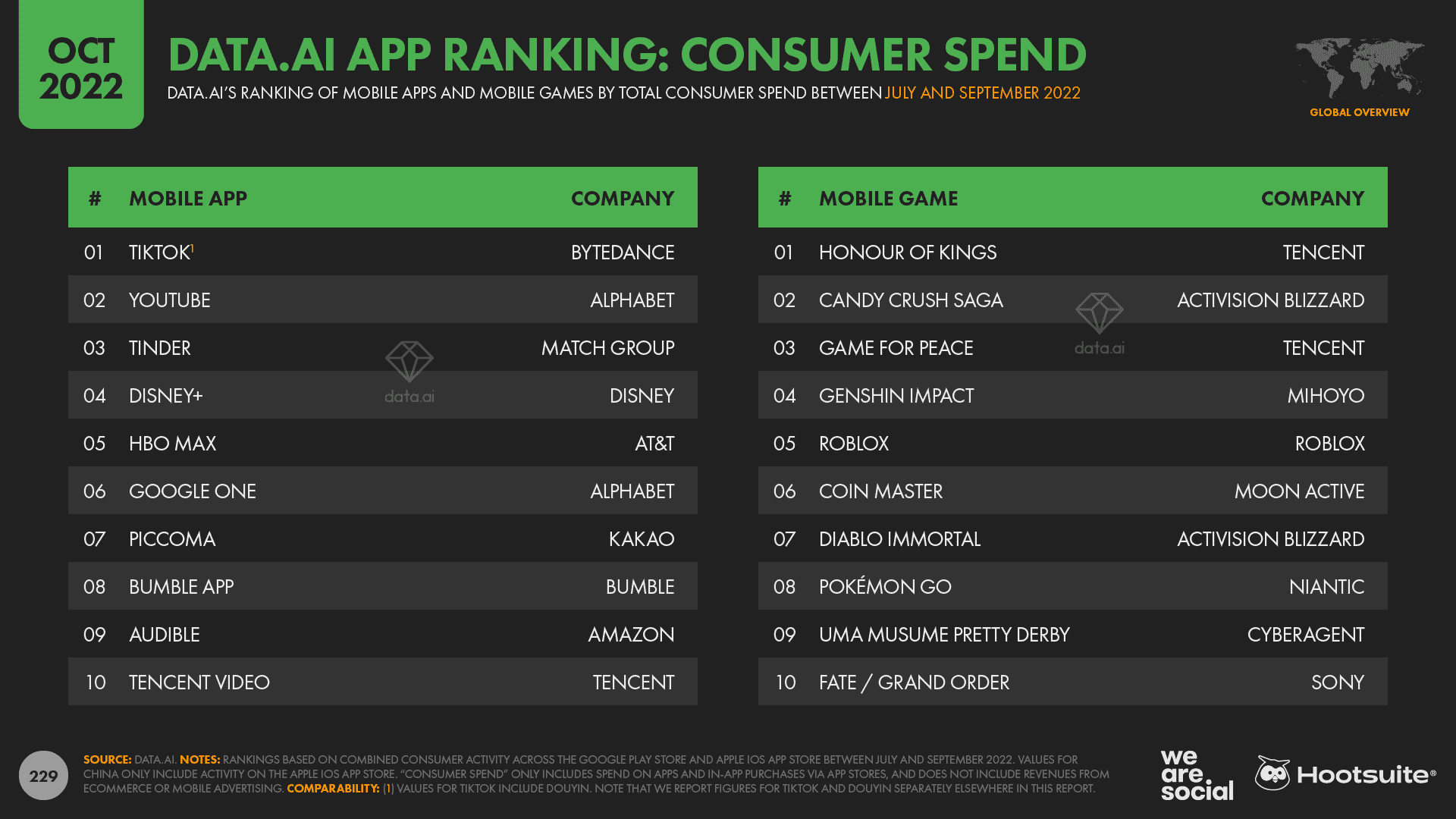

And it’s not just TikTok’s ad reach that’s growing, either; users continue to spend more and more money on the platform too.

Analysis from Sensor Tower reveals that TikTok’s worldwide revenues – which include spend on Douyin in China – reached more than USD $914 million between July and September 2022, taking its cumulative, lifetime total to roughly USD $6.3 billion (Note that we separate user figures for TikTok and Douyin elsewhere in our reports.)

And what’s more, this revenue figure only includes consumer spend on TikTok – which comes largely via the purchase of TikTok Coins – and doesn’t include the revenues that Bytedance earns from advertising.

Both data.ai and Sensor Tower report that TikTok was the world’s top grossing non-game mobile app in Q3 2022, as ranked by combined consumer spend across the Google Play and Apple iOS stores.

The outlook for Facebook

However, it’s unlikely that recent changes in Meta’s reported ad reach will correlate with equivalent drops in monthly active users (MAUs).

The company did announce a drop in monthly active user figures in its Q2 earnings announcement, and Zuck and team may well announce a similar trend in the company’s next investor update.

But the decline in Facebook’s MAUs between April and June 2022 only amounted to 2 million users, which equated to a drop of just 0.1% of the global total—considerably less than the 4.1% decline in reported ad reach over the same period.

Based on the size of this difference, my assessment is that changes in reporting methodology are likely to be the main factor contributing to the recent drop in Meta’s reported ad reach, rather than a sudden drop in its active user numbers.

Guidance in the company’s ad planning tools reinforce this hypothesis, with a pop-up note next to reported ad reach figures now stating that this metric is “in development”:

“An in-development metric is a measurement that we’re still testing. We’re still working out the best way to measure something, and we may make adjustments until we get it right.”

The note goes on to clarify why existing metrics like ad reach might be re-classified as “in development”:

“We frequently launch new features and new ways of measuring how those features perform. Sometimes we publish these metrics even when the way we calculate them isn’t final to get more feedback, make them better and figure out the best way to measure performance.”

However, regardless of the cause, the latest figures are still considerably lower than the potential reach that Meta’s tools reported just a few months ago.

As a result, marketers should carefully review the latest ad reach numbers for their brands’ specific audiences, in order to understand and quantify what paid media activities might deliver.

It’s also important to highlight that the figures for potential ad reach published in Meta’s planning tools are largely influenced by the number of people who were shown ads on its various platforms over the preceding 30 days.

As a result, it’s worth considering that any drop in reported potential reach may also be influenced by the number of advertisers buying ads on Meta’s platforms, and also the scale of their media spend.

For example, a drop in the number of advertisers—or in the amount that those advertisers spend on each platform—might result in fewer users seeing ads on Meta’s platforms, which in turn might affect the potential reach figures that the company’s tools report.

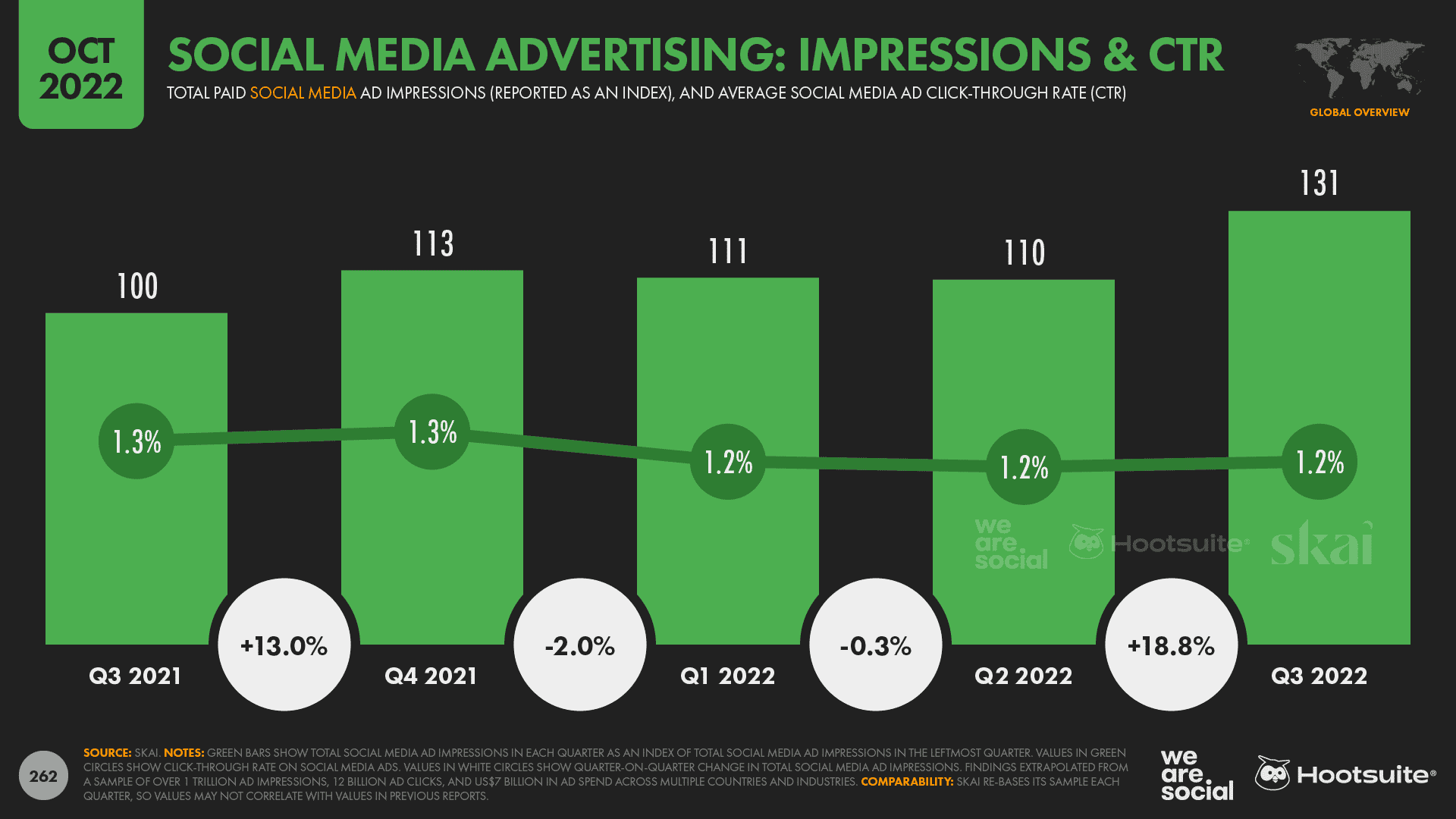

However, the latest data from Skai suggests that marketers actually spent more on social media ads in Q3 2022 versus Q2.

Moreover, average social media CPMs (the cost to deliver 1,000 social media as impressions) actually fell over the past 3 months, so that increased investment resulted in an 18.8% increase in the number of social media ads that were shown to users across all social platforms.

As a result, if the decline in reported reach across Meta’s various platforms were to have been affected by the number of advertisers and size of their investments, this might point to a decline in Meta’s share of the overall social media advertising market.

Google Ranking Factors Takeaway

The main thing to take away from this article is that ranking and SERP visibility is not a straightforward application of “here is a list of ranking factors that we can work with.”

It’s one of the reasons why this industry is such an exciting and challenging space to work in.

All that said above, although there is not a clear set of Google ranking factors that you can follow, there are a number of factors and signals that are important to get right to achieve the best ranking you can.

Start by really understanding Google’s motivation and how it works. Then, you can start to understand how to shape your approach to content and SEO strategy in order to rank.

If you want to read more about ranking factors with a focus to prioritize facts and not speculation, then download a copy of Ranking Factors 2023 ebook.

In researching this article, the author spoke directly to Pedro Dias (former Google employee), Ammon Johns (SEO Pioneer), and Dan Taylor (Russian search engine and technical SEO expert). Many thanks to them for their input and expertise.

More resources:

- History of Google Algorithm Updates

- How Search Engines Work

- Ranking Factors 2023: Systems, Signals & Page Experience

Featured Image: Jeramey Lende/Shutterstock

YouTube tops time spent

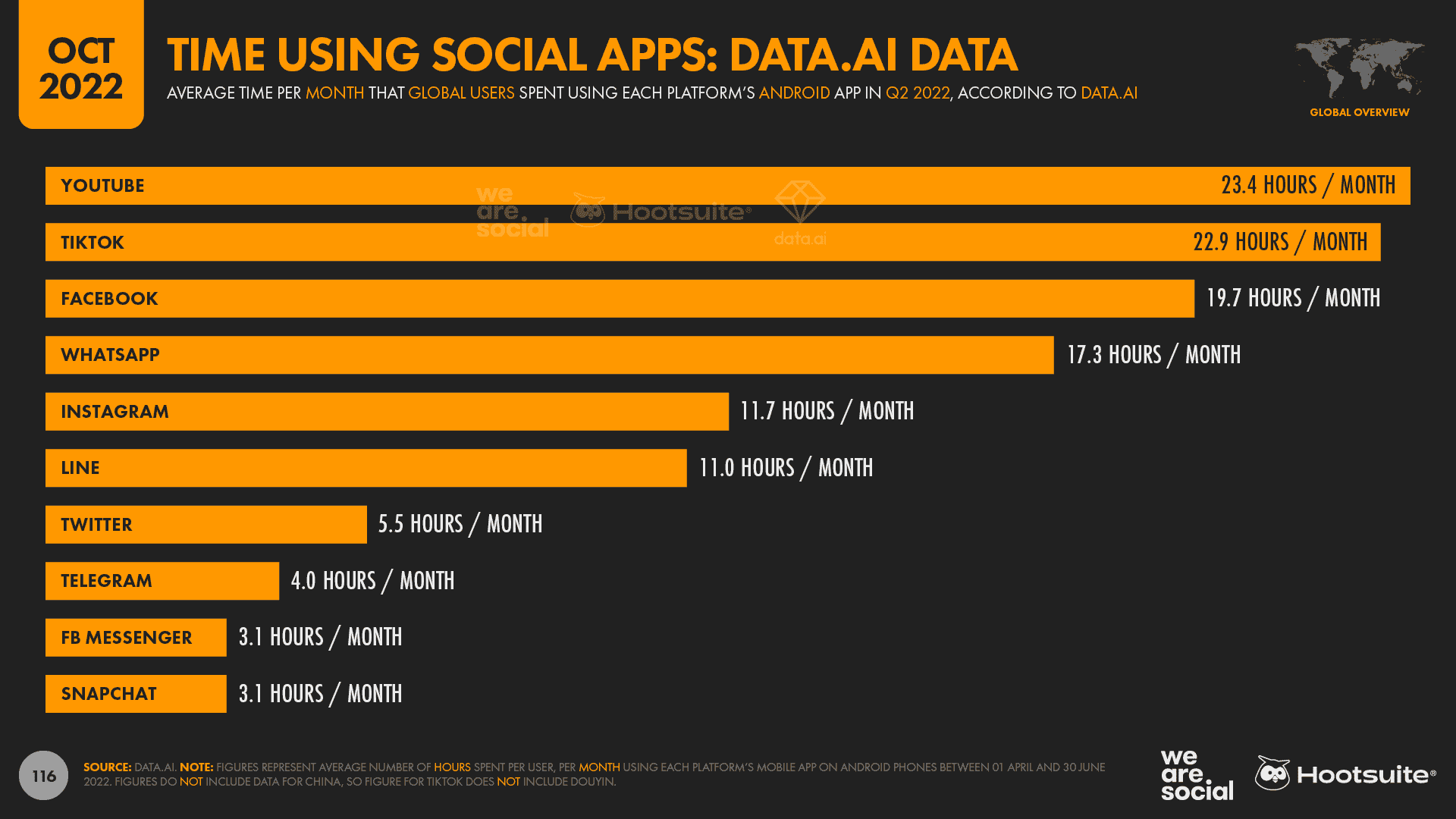

As you may have noticed in one of the charts we featured above, YouTube has reclaimed top spot in data.ai’s latest ranking of social media apps by average time spent.

The typical user spent an average of 23.4 hours each month using YouTube’s app between 01 April and 30 June 2022, equating to almost one-and-a-half days of total waking time.

TikTok slipped back to second place in the Q2 ranking, with users outside of mainland China spending an average of 22.9 hours per month using the short-video platform in the second quarter of 2022.

As we noted above though, data.ai’s numbers have better news for Facebook, which saw its average monthly time per user increase to 19.7 hours per month in Q2, compared with 19.4 hours per month in the first three months of 2022.

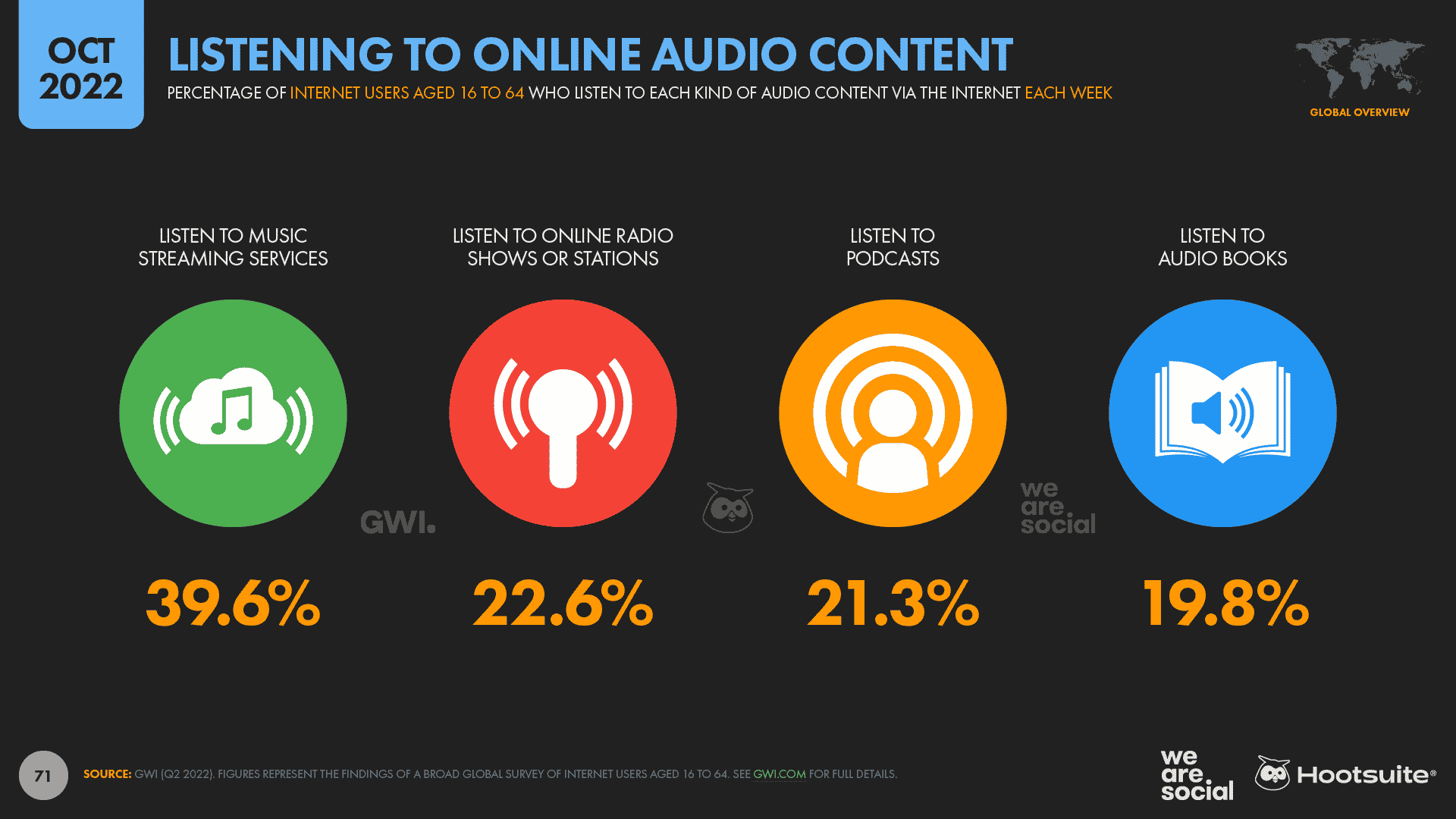

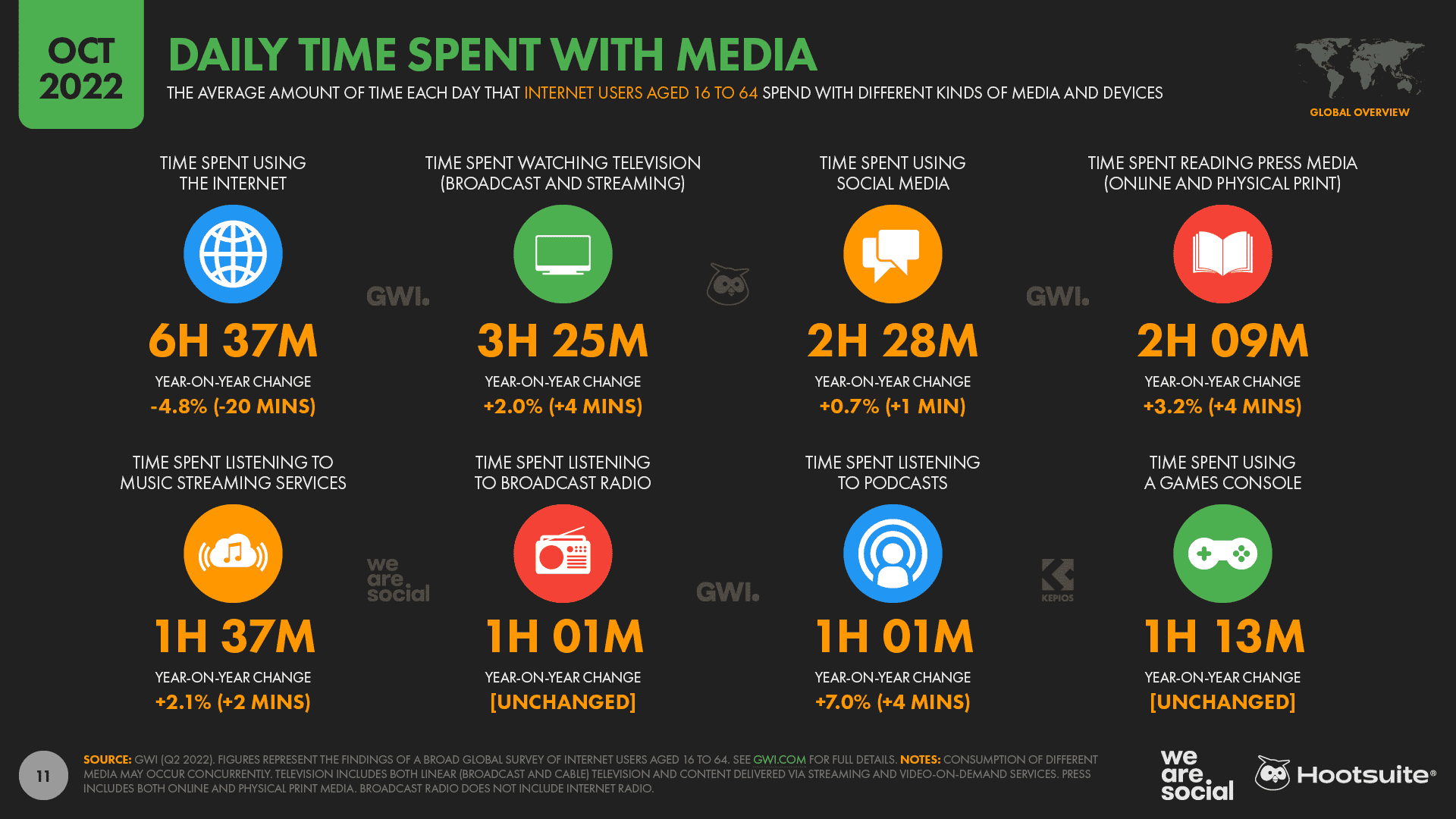

Podcasts capture more of people’s time

The latest data from GWI reveals that the typical working-age internet user now spends more than an hour per day listening to podcasts.

At a worldwide level, the average daily time spent listening to podcasts has increased by 7% over the past year, equating to an additional 4 minutes per day.

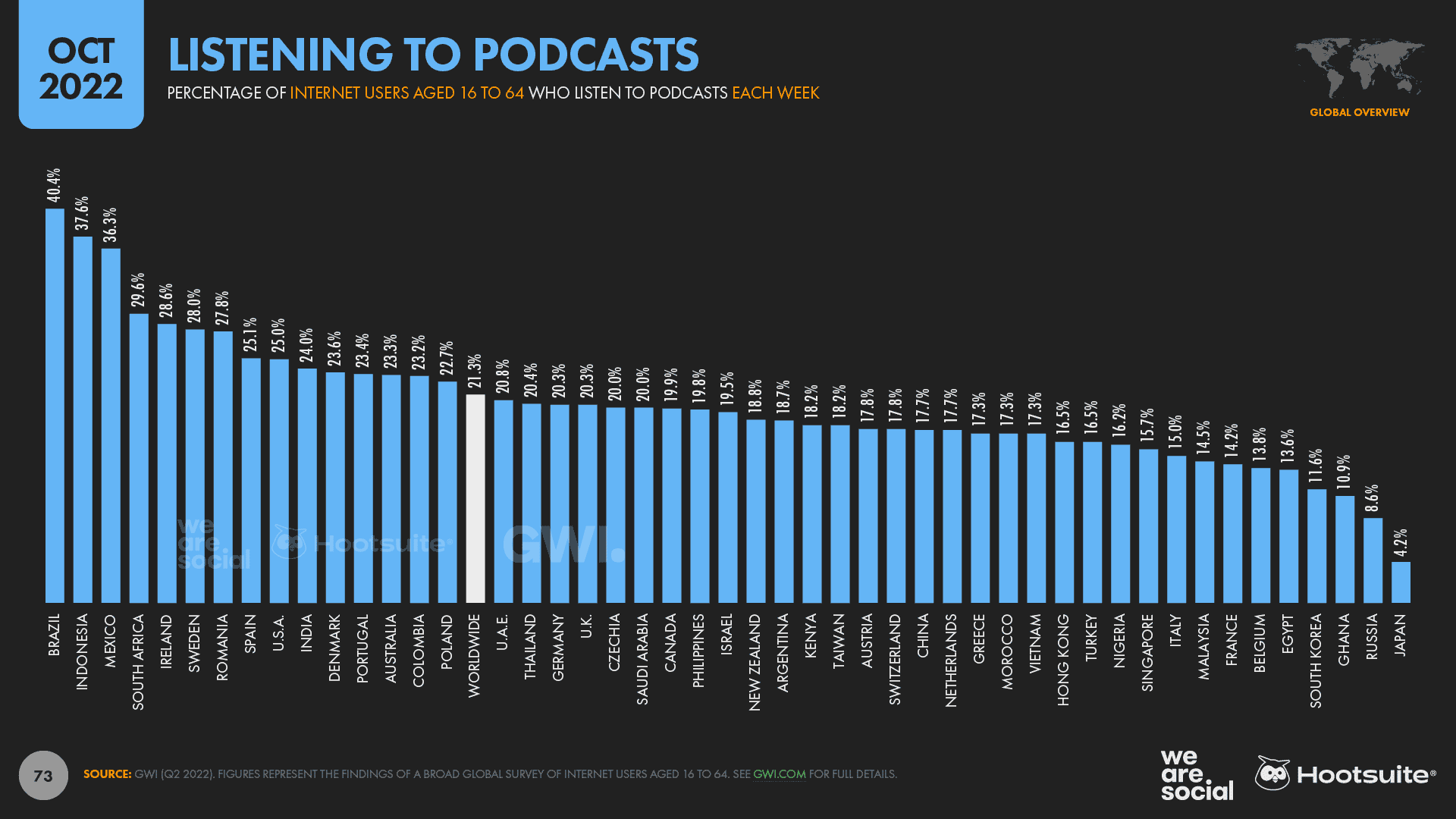

21.3% of internet users aged 16 to 64 now listen to podcasts each week, for an average of 61 minutes per day.

For perspective, these figures suggest that working-age adults in the 48 countries covered by GWI’s survey will spend a combined total of more than 24 million years listening to podcasts in 2023.

It’s interesting to note that the popularity of podcasts varies significantly by culture, although there’s no obvious pattern connecting countries where podcasts are either more or less popular.

Brazilians are the biggest consumers of podcast content, with more than 4 in 10 working-age internet users in the country saying that they listen to at least one podcast each week.

At the other end of the spectrum, Japanese people are the least likely to consume podcasts, with fewer than 1 in 20 working-age internet users in the country saying that they’ve listened to a podcast in the past seven days.

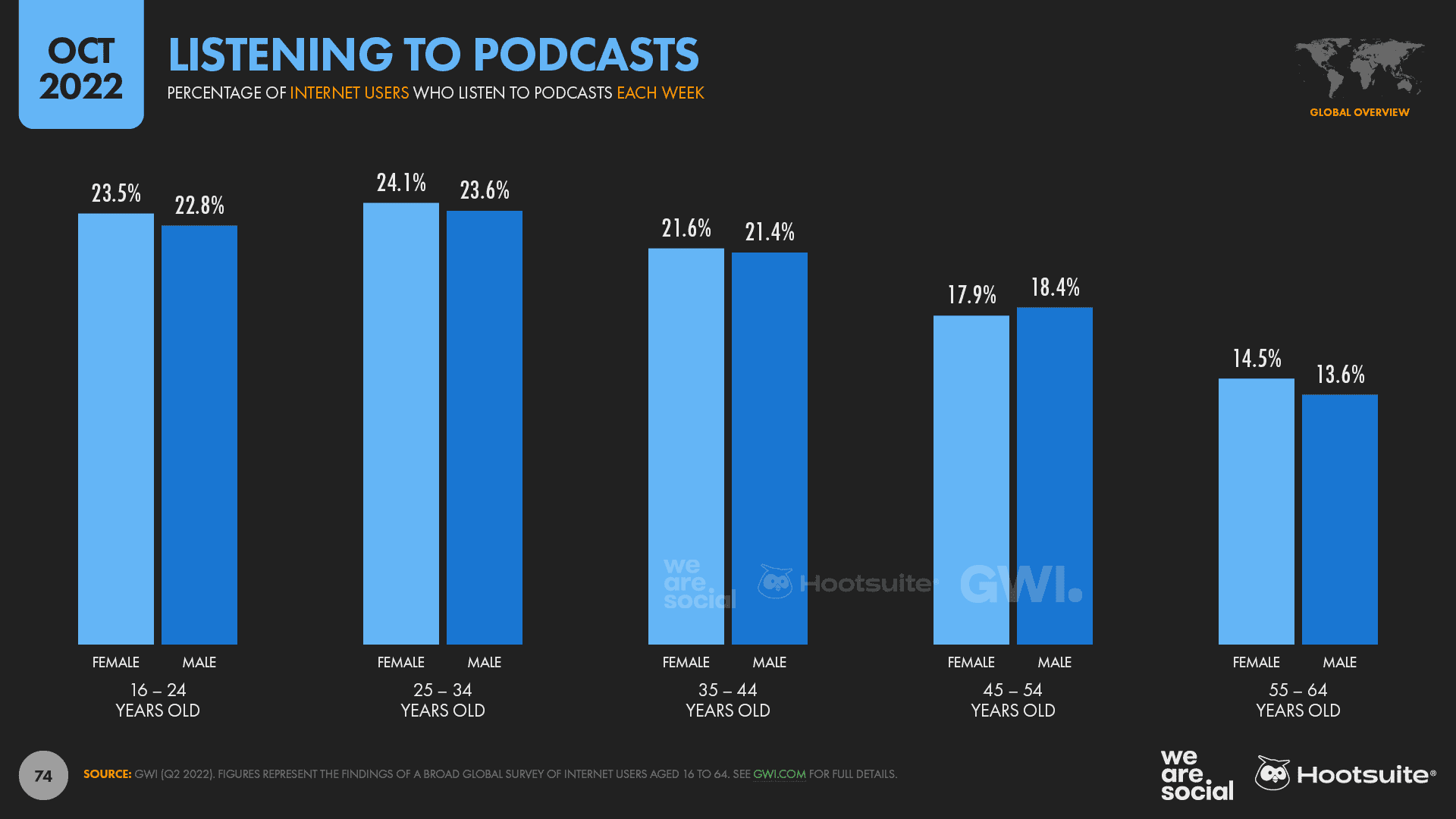

Younger age groups are more likely to listen to podcasts than their parents’ generation, although Millennials are ahead of Gen Z when it comes to the share of internet users who tune in to podcasts each week.

It’s also interesting to note that women are more likely to say that they listen to podcasts compared with men, which may go against the stereotype of the “typical” podcast listener.

Factors, Systems, And Signals

Whenever Google documentation is updated – or Gary Illyes, John Mueller, or Danny Sullivan make a comment – SEO professionals obsess over the meaning.

This is an issue for Google and for the SEO industry at large, because SEO pros are often looking way too deeply at the wrong thing and losing focus on what really matters. Nothing seems to be held to more scrutiny than ranking factors.

SEO professionals are becoming fixated on the semantic differences between factors, systems, and signals.

When documentation was updated to remove page experience from the Systems page, Google was forced to put out this statement on X (Twitter): “Ranking *systems* are different than ranking *signals* (systems typically make use of signals). We had some things listed on that page relating to page experience as “systems” that were actually signals. They shouldn’t have been on the page about systems. Taking them off didn’t mean we no longer consider aspects of page experience. It just meant these weren’t ranking *systems* but instead signals used by other systems.”

As it turns out, page experience is still a ranking factor (see below).

Digging into the semantics, Google has two official pages that relate to ranking factors:

A guide to Google Search ranking systems:

How Search Works:

Gary Illyes covered the differences between factors, signals, and systems during an Ask Me Anything session at PubCon (September 2023), where he said, “The main difference is just language.”

The easiest way to define between system and signal is to say Google’s ranking systems can be thought of as the machine learning layers that are applied to refine search results. Ranking signals influence the systems and ranking.

In a direct message, SEO expert Ammon Johns clarified this by saying: “Not all things that are classed as signals will be used in any one system. Many things that Google classifies as signals may not be applicable to a particular query, or may be weighted differently to that of another query. For example, even Google’s most famous of all signals, PageRank, isn’t used in Local Search at all.”

The Google “How Search Works” page talks about “key factors that help determine which results are returned for your query.”

On this page, the main factors are summarized as:

- Meaning.

- Relevance.

- Quality.

- Usability.

- Context.

If you can understand the fundamental approach that Google takes, then distracting yourself with semantics is not important. Following a common sense approach to the end goal for the end user is a much more effective and long-term strategy.

Basically, Google is driven by wanting to provide the best search results it can so that it has a market-leading product. It’s a business. Once you understand this, you understand the fundamental concept of SEO.

With all that said, here are the fundamental ranking factors that should all be considered for SERP visibility.

How Facebook stacks up to TikTok

But while we’re on the subject of how headlines can distort our perspective, let’s compare Facebook’s latest numbers with some other platforms that seem to be current media darlings.

To be clear, I’m not advocating for Facebook here; I simply want to provide some objective perspective.

Firstly, numbers reported in each company’s ad planning tools indicate that marketers can still reach twice as many adults aged 18 and above with ads on Facebook as they can with ads on TikTok.

Sure, the figures for teens might look a bit different, but Bytedance’s tools don’t report data for users below the age of 18, so it’s difficult to know for sure.

Moreover, if you’re not actively targeting teenagers, trends amongst younger users offer little more than trivia, and—as a marketer – you’d do better to focus your attention on what your specific audiences are actually doing today.

Next up, BeReal.

Yes, the platform is generating lots of buzz, and yes, the platform appears to be growing quickly.

Indeed, data from Sensor Tower reveals that—since launching just 2 years ago – the app has been installed on a cumulative total of 53 million smartphones.

However, it’s important to stress that this figure doesn’t equate to active users, and figures from August 2022 suggest that the app currently sees just 10 million daily active users.

And even if that number were to have doubled since August, Facebook would still reach roughly 100 times as many daily active users as BeReal.

None of this is to say that BeReal and TikTok are bad choices of course; nor am I saying that you should necessarily prioritize Facebook.

I’d simply like to add a dose of realism to your 2023 planning.

As a gentle reminder, our job as marketers is to build brands and drive sales – it’s not to jump on all the latest bandwagons.

Sure, if you can see a clear way to deliver efficient and effective outcomes via the hottest new platform, by all means go for it.

But don’t expect magic from a platform simply because it’s making headlines.

Critically, if you haven’t already made that “magic” happen on Instagram or TikTok, there’s no reason to expect that you’ll fare any better on BeReal—or on the next hot platform that will surely come along behind it.

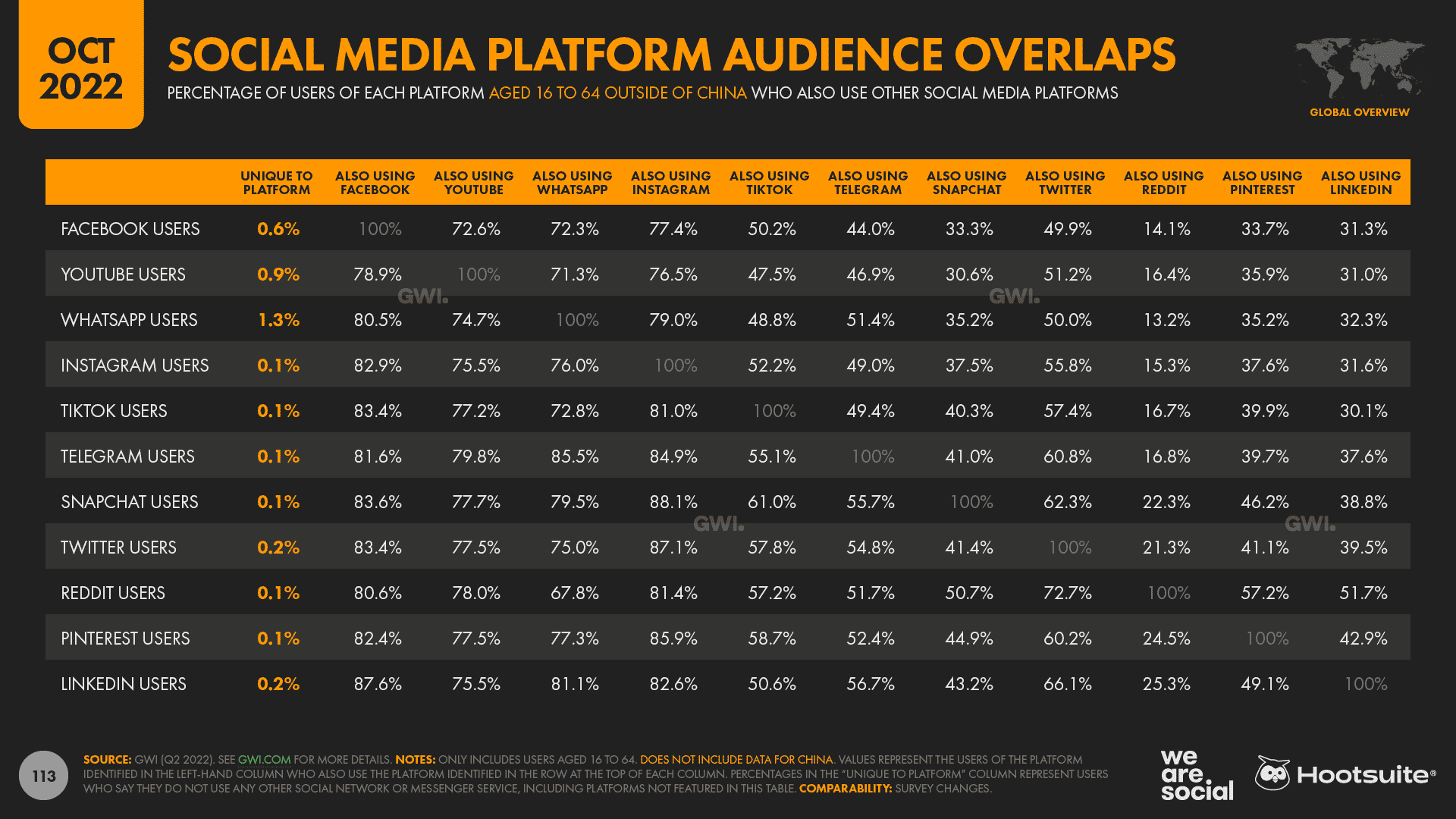

And that’s because the users of any given social platform are largely the same, even if each platform offers a slightly different demographic profile, and slightly different opportunities to engage people.

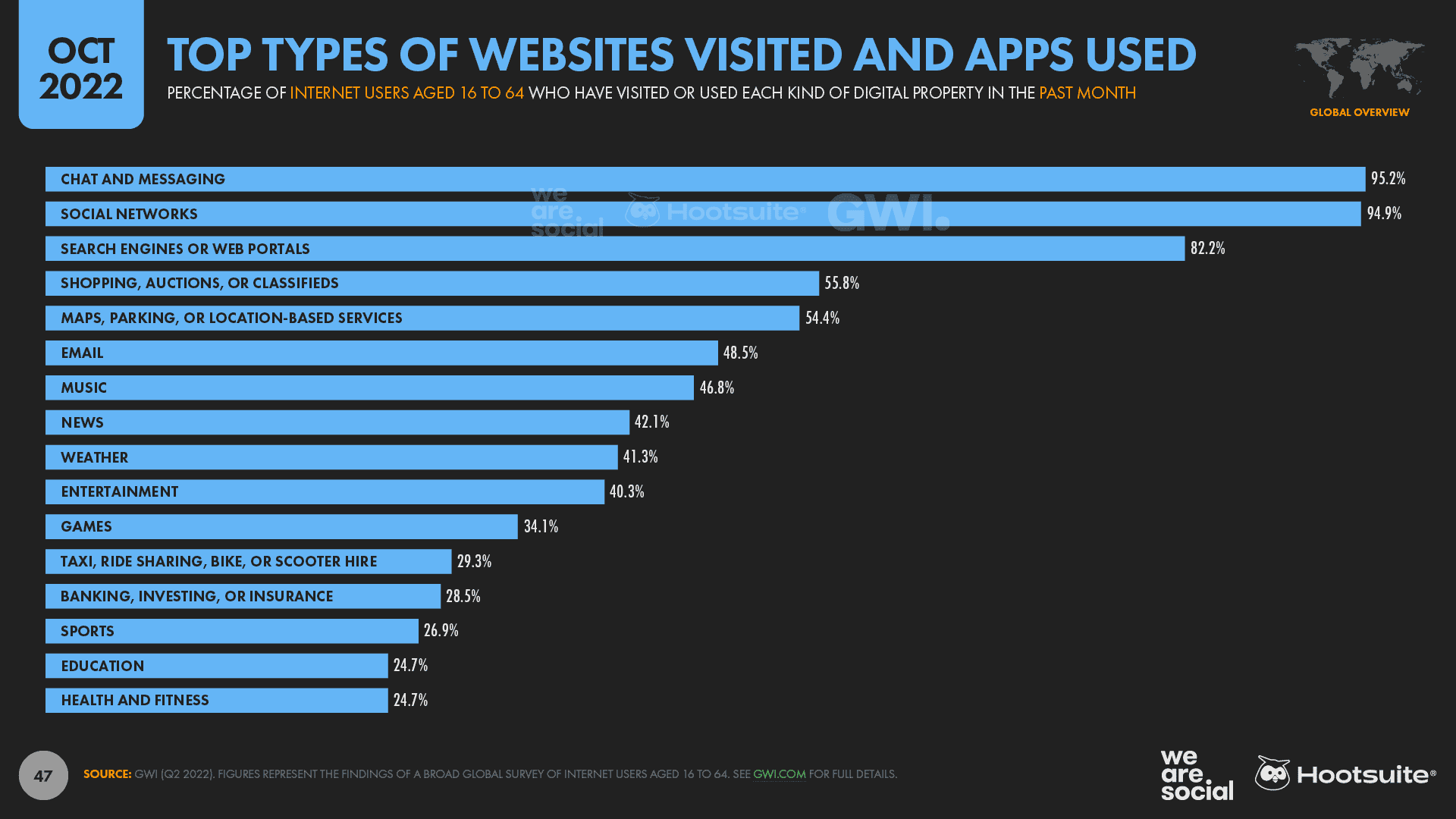

For context, 95% of working-age internet users say that they use messaging apps and social networks each month, so it’s highly unlikely that you’ll be able to reach any “unique” users on a new social platform.

Indeed, as the excellent data from GWI in the chart below shows, even the largest and most established platforms can barely claim 1% unique reach, while fewer than 1 in every thousand users on newer platforms like TikTok can be considered unique.

So, given that marketers everywhere will be under increased scrutiny over the coming months as fiscal belts tighten, my advice would be not to abandon tried and true favorites like Facebook in favor of “shiny new objects”.

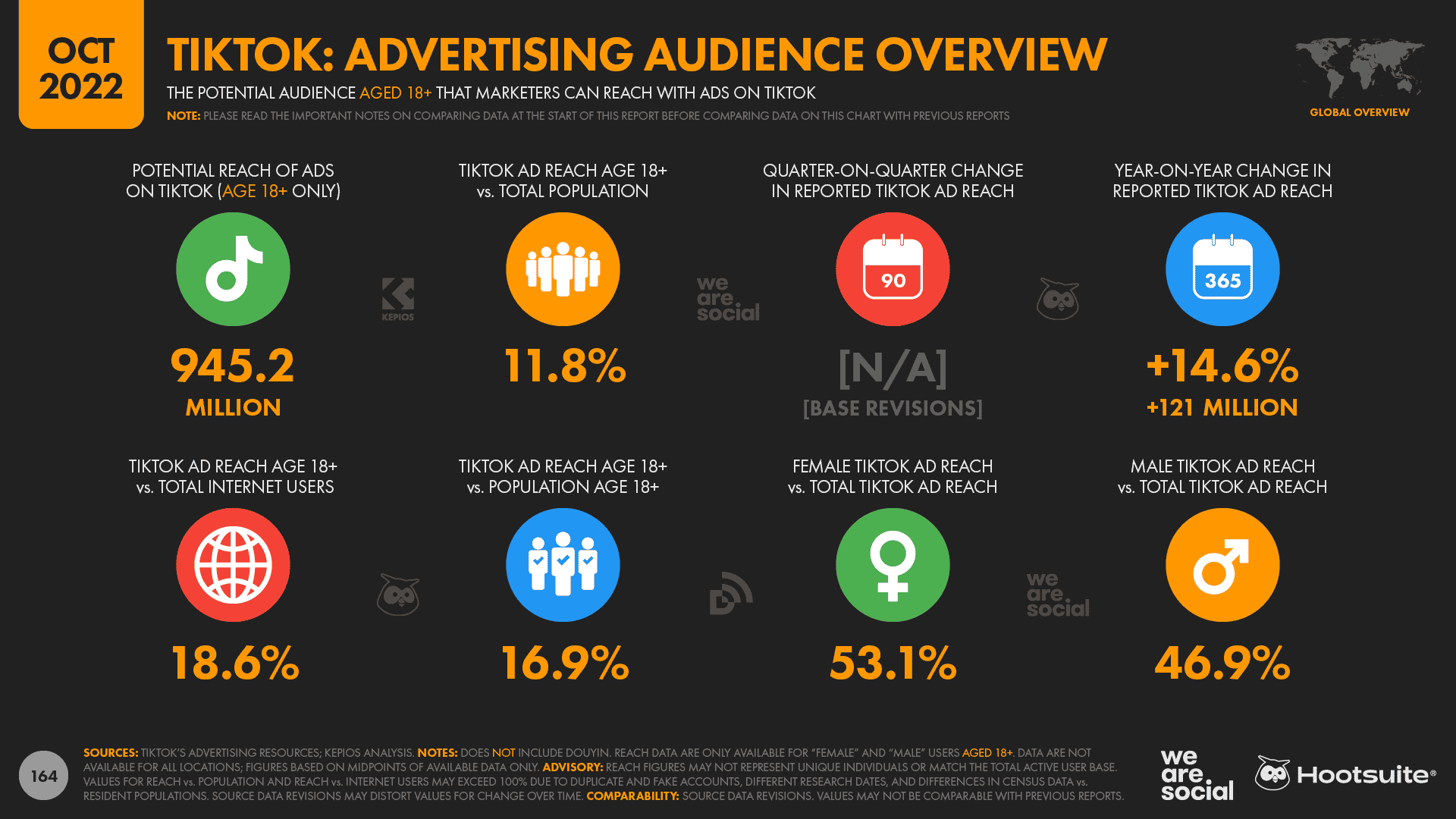

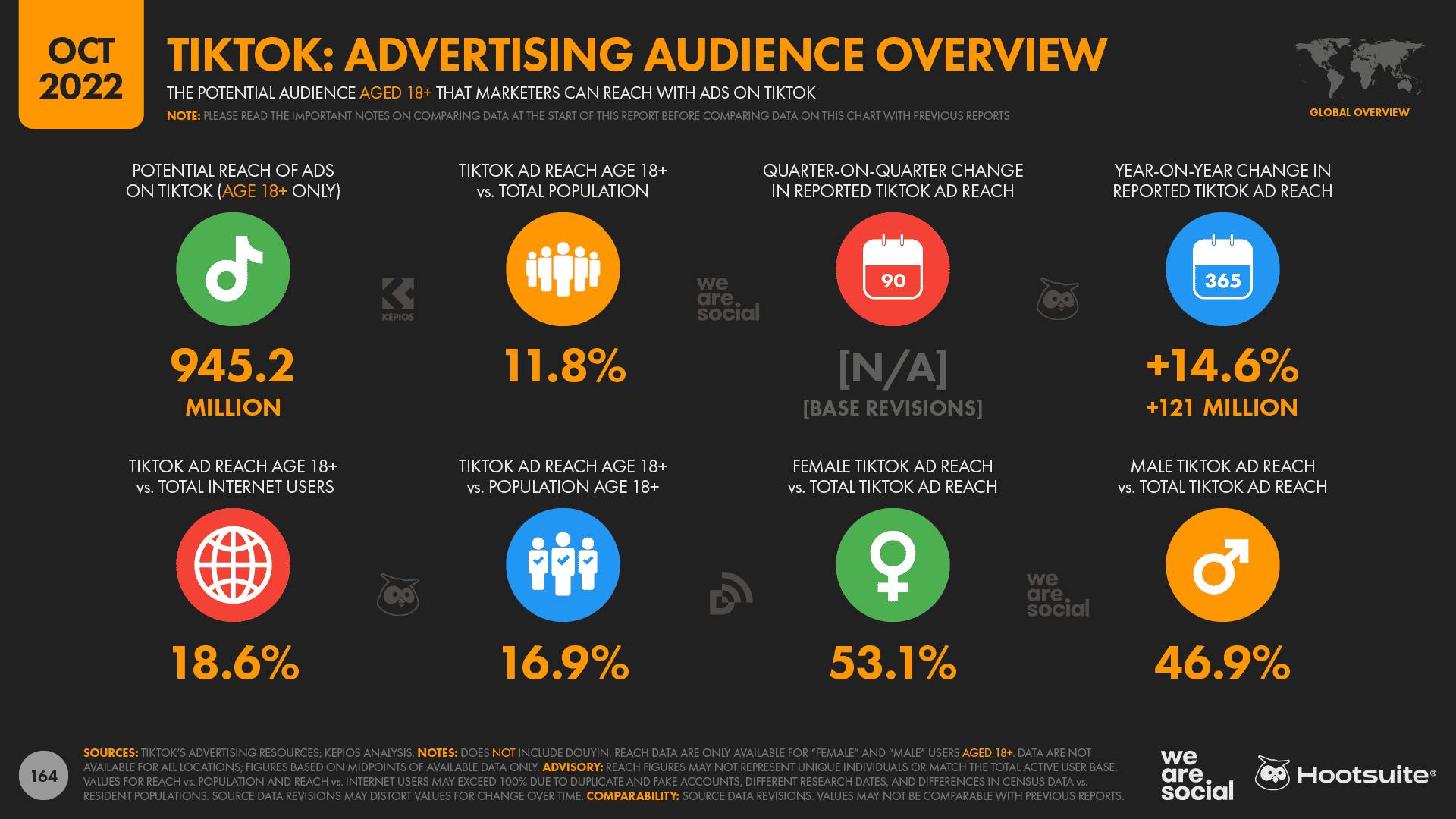

TikTok keeps climbing

Due to quirks in the way that Bytedance’s tools report potential advertising reach for its various services, we’ve revised our ad reach numbers for TikTok in our October 2022 report.

However, it’s important to stress that these numbers don’t represent a decline in TikTok use compared with previous quarters.

Rather, the difference in our reported numbers results from a change in the source data that we use to calculate the numbers that we report.

Based on these revisions, our latest analysis indicates that TikTok ads now reach 945 million adults over the age of 18 each month, which is 121 million more than they reached just 12 months ago.

TikTok’s ad reach has grown by 14.6% over the past year, and the platform’s ads now reach more than 1 in 6 adults on Earth every month.

People get more intentional about time online (and social)

There’s an overall decline in the time we spend online, but that doesn’t necessarily mean that the internet is losing importance in our lives.

Even at the current average of 397 minutes per day, the typical global internet user still spends more than 40% of their waking life online.

GWI’s research and analysis indicate that people are trying to become more “purposeful” in their use of the internet, especially after the rapid rise in time spent using social media during COVID-19 lockdowns.

As Tom Morris, Trends Manager at GWI, told us in a recent interview,

“We believe that the world has effectively reached a “saturation point” for time spent using the internet. In recent months, average daily time spent has actually decreased worldwide, across all generations, and even in internet growth markets like the Middle East and Latin America. We believe this is mostly the result of increasing mistrust in the news and rising social media-induced anxiety, especially as social media accounts for an increasingly prominent share of overall online time.”

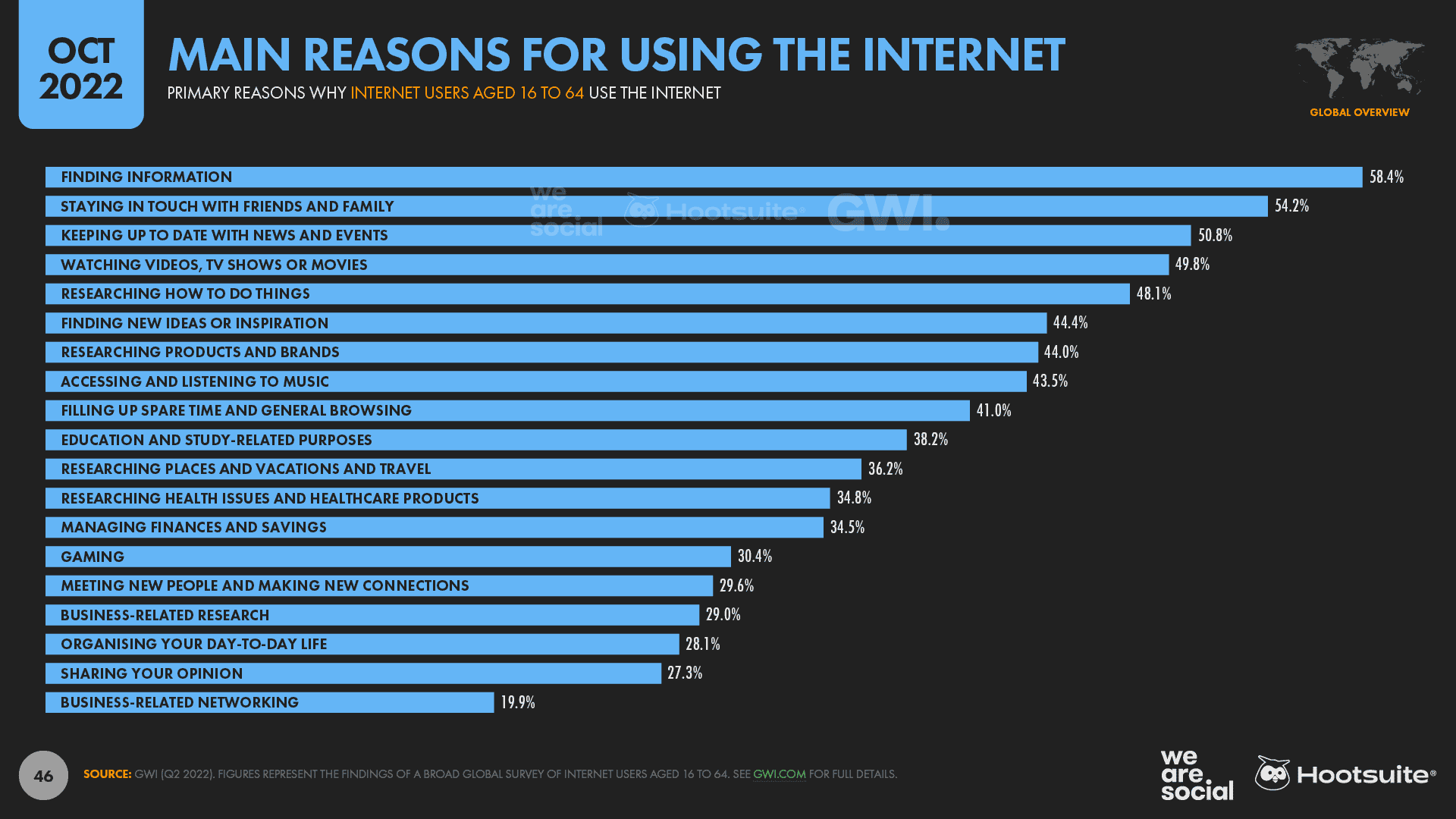

It’s also interesting to note that—while people’s motivations for using the internet haven’t changed much since the pre-COVID era—the number of people who choose each option in GWI’s survey has declined across all options.

Once again, this change suggests that people may be more “selective” in how they spend their time online, hinting at a more considered and purposeful approach to using connected tech.

So what does all of this mean for marketers?

Well, the key takeaway here is that we also need to be more purposeful, ensuring that our marketing activities and content actively add value to our audiences’ online experiences.

In particular, marketers need to be particularly conscious of adding value when they use interruptive ad formats—especially when it comes to the content we add to people’s social media feeds.

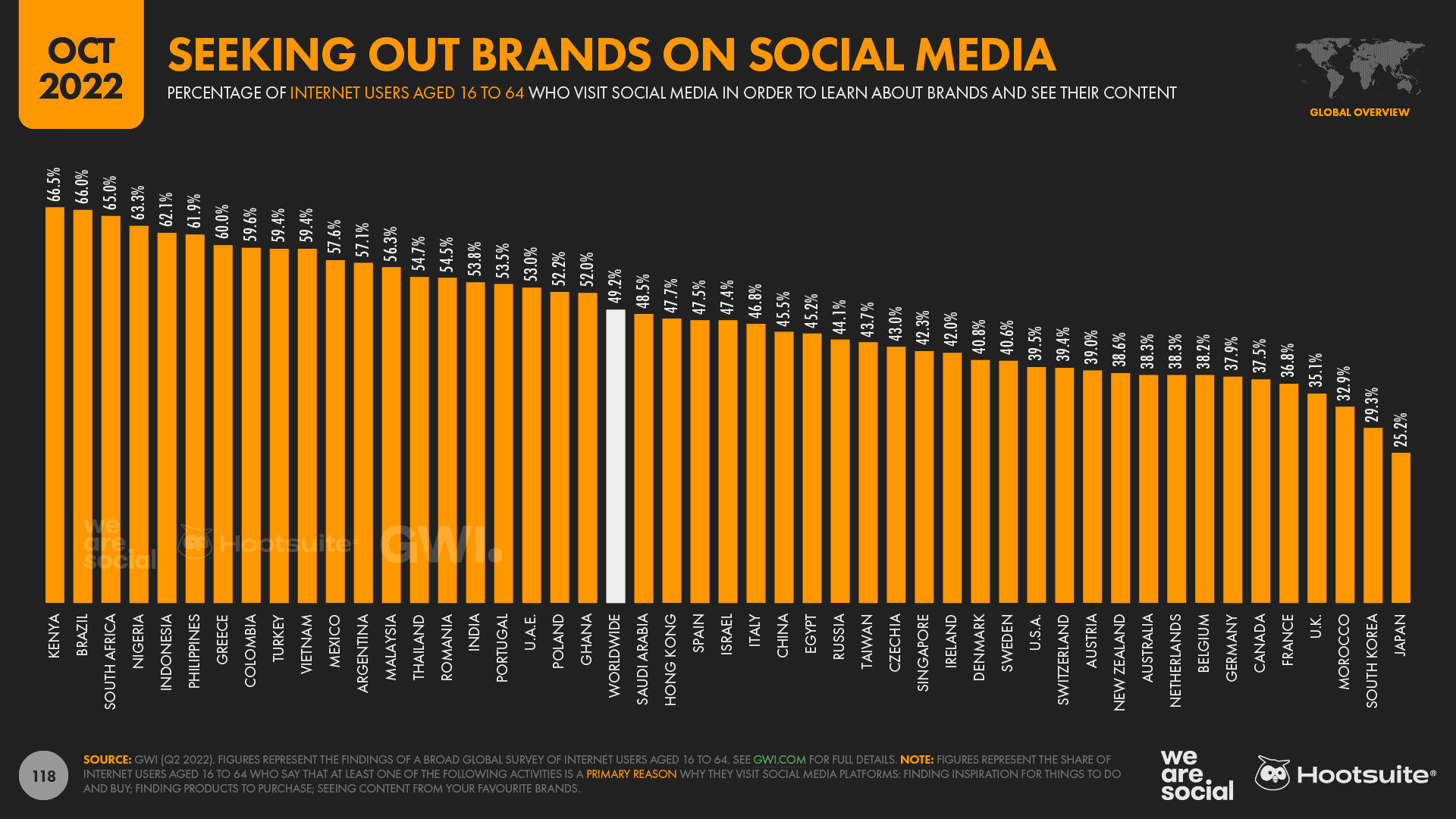

On the one hand, the latest data reveals that roughly half of all working-age internet users actively visit social platforms to learn about brands, and to research products and services that they’re considering buying.

However, with people becoming more thoughtful about where and how they spend their online time —especially in social media—it’s essential that brands don’t risk irritating their audiences with irrelevant content.

Furthermore, with many marketers facing budget cuts due to the challenging economic outlook, it’s never been more important for us to ensure that our investments in media and content deliver tangible value—both to audiences, and to the brand’s bottom line.

No one arrested in 4 vehicle thefts

Shensel, for her part, said her car did not end up in a shipping container or overseas when it was stolen the first two times.

The first time, it was dumped in a west-end Toronto parking lot and recovered by police. The second time, it was dumped around the corner from her mother’s house about 800 metres from Shensel’s home. A neighbour called police about the car and Shensel picked it up from the police.

The Range Rover had a steering wheel club that obviously did not deter the thieves, she said.

Her big concern now is that the rise in auto thefts will «jack up» rates.

«Everyone’s insurance is going up because of what happened to me,» she said.

In its 2024 auto outlook, Ratesdotca says car insurance premiums are expected to keep climbing in 2024, with inflation and rampant auto theft driving the charge. The organization noted that Ontario’s regulator has already approved rate increases for about two dozen insurance providers in the first quarter of the year.

According to Toronto police, Shensel has reported four vehicle thefts since January 2023, one being a rental. None of the cases have been closed because none have resulted in arrests, police said.

Вопрос школьника по предмету Английский язык

СРОЧНО, 20 БАЛЛОВ

Чтение

Прочитайте тексты и установите соответствие между текстами и из заголовками: к каждому тексту, обозначенному буквами A-G, подберите соответствующий заголовок, обозначенный цифрами 1-8. Используйте каждую цифру только один раз. В задании есть один лишний заголовок.

1. A greater choice

2. At any hour

3. Make sure if an online site is trustworthy

4. The main advantage

5. Online shoppers, who are they?

6. The methods are the same

7. The only inconvenience

8. Keep your shopping under control

The Internet has now become the shopping centre of America. An overwhelming 76% of online users have bought at least one product or service. Online shoppers are like a snapshot of a busy shopping centre on a Saturday afternoon. They are your husband, your wife, your girlfriend, your brother, your children, and even your grandparents. They are more or less half man, half woman – 51% to 49%.

Before the Internet, you would go to the shopping centre or buy through a mail order catalogue. With the evolution of online shopping, buying items is as easy as the click of a mouse. Both online and traditional shops have modern techniques which are used to make you to buy products. There’s a science behind what makes people spend money. Just like traditional shops can make you buy as many items as possible, online shops can, too: the people online are not different from the people who shop in real shops; they’re one and the same person.

Online shopping has its problems and risks, but it is still very popular. It is true that you definitely have to do your best to avoid these risks. However, the Internet is much better than traditional shopping. Unlike traditional stores, which often have times they’re closed, online shopping is open 24 hours a day, seven days a week from your computer or any mobile device. You can shop in the middle of the night, early in the morning, or any time is that is good for you. Online shops never close.

With the help of online shops, people can buy things from all over the world and at relatively cheaper prices with equally good quality. Online shopping is great, and it is no more risky than dealing with a physical shop. An online site is no more dangerous than using a credit card in a real shop. But the problem is not that not all online shops can be trusted. There will always be crime and always be criminals. So you should learn more before you start to shop online.

Shopping online is not without its problems or risks, but it suits perfectly those who do not wish to travel to a real store. Shopping online not only gives customers more choices, better prices, and product reviews, it gives shoppers a way to avoid long queues during busy shopping times, and it saves gas for shoppers. Also, the weather never affects the process of online shopping. The most trouble you’ll have with shopping online is going to the post office.

Online shopping is, for many reasons, much better than traditional shopping. First of all, there is a much broader selection of goods which you can buy. With the help of online shops, people can buy things from every corner of the world. More than that, there are many products that can be bought exclusively online. Shopping online people can buy things they cannot otherwise get. It is the perfect place to find everything you want to buy.

Before you go online, decide what exactly you are going to buy. Make a list of items you need and then keep to it. Avoid clicking on other items or recommendations to limit the wish to buy more than you have planned. Limit your shopping time so that you are focused only on what you are looking for. Set an online shopping budget and don’t spend more. Don’t shop when you are stressed. You might buy items you don’t really want or need.

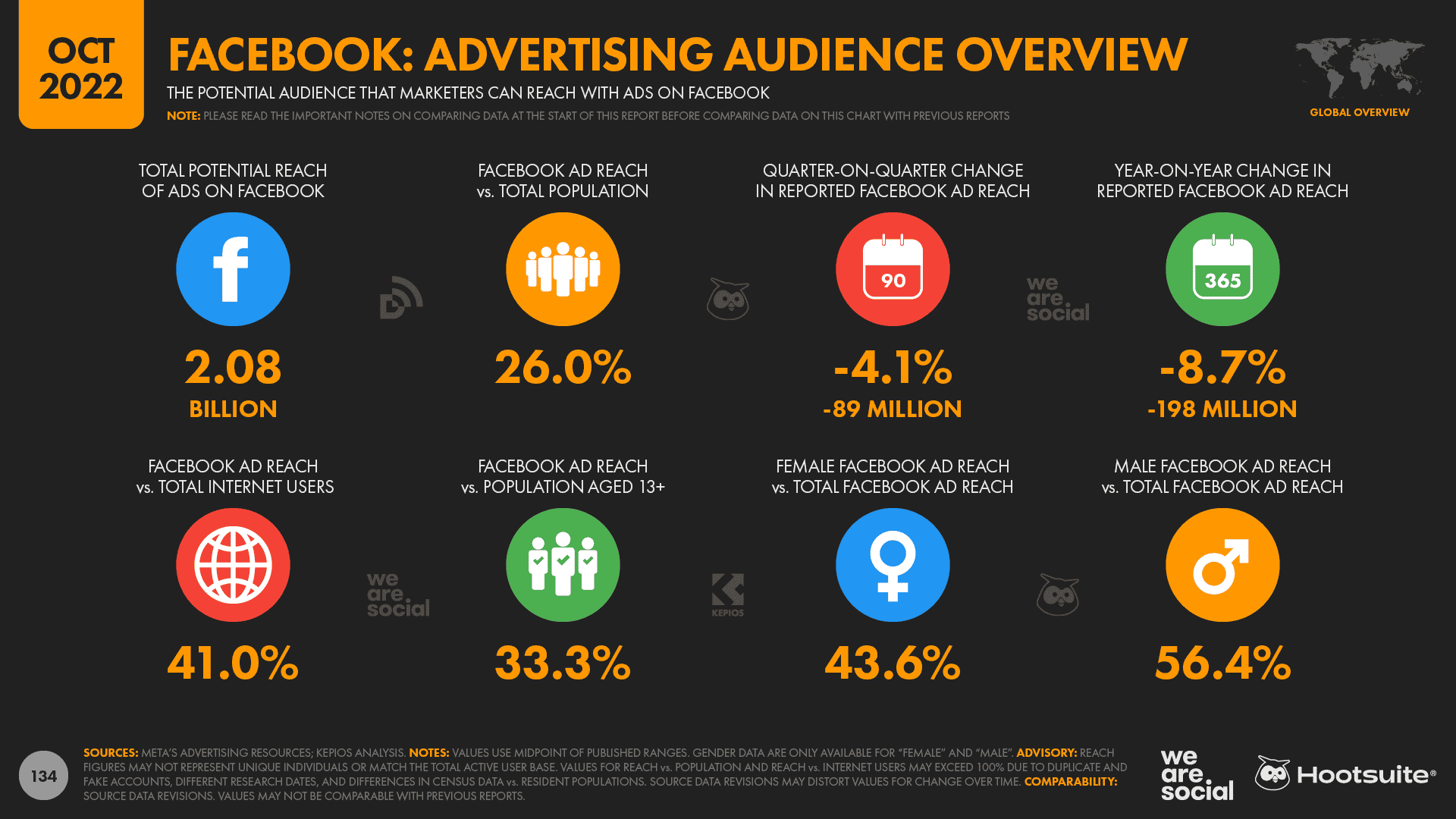

Meta revises its numbers… again

Meta appears to have made yet more revisions to its advertising audience reach figures.

The latest numbers published in the company’s ad planning tools are significantly lower across all three of its advertising-focused platforms, even compared with the numbers that appeared in the same tools just 3 months ago:

- -4.1% vs. July 2022, equating to a drop of 89 million users

- Instagram: -3.8% vs. July 2022, equating to a drop of 54 million users

- Facebook Messenger: -2.4% vs. July 2022, equating to a drop of 24 million users

- Combined reach across all platforms and the Audience Network: -5.5% vs. July 2022, equating to a drop of 161 million users

These revisions aren’t uncommon though—especially at this time of year—and we’ve seen the company make similar revisions to its reach numbers on numerous occasions over the past decade.

However, we’ve noticed that such revisions have become more frequent over recent months, and the company appears to have revised its figures for Instagram at least twice since the start of 2022.

Moreover, this is the first time that we’ve seen the company revise figures for all of its platforms at the same time.

Historically, we’ve avoided reporting figures for change over time when we’ve detected these kinds of revisions, because the subsequent change in published figures doesn’t necessarily correlate with an actual drop in “genuine” reach.

For example, these revisions may reflect a purge of duplicate and “fake” accounts, and as such, a drop in reported reach doesn’t necessarily mean that marketers can reach fewer ‘real’ people in their target audiences.

However, given the scale and frequency of recent revisions, we’ve decided to publish these change figures from hereon, in order to help marketers make better informed decisions.

This is partly because the potential global Facebook ad reach figure published in the company’s tools is now lower than the figure that the same tools reported this time four years ago.

In October 2018, Meta’s planning tools reported potential global Facebook ad reach of 2.091 billion, but the same metric stands at just 2.079 billion today.